One of the basic acronyms in the travel industry stands for a system that is simply essential for its activities. This definitive guide breaks down what a Global Distribution System is, compares the key market players, and outlines how to choose the right one for your business.

Whenever we make travel plans, we need to book several services ahead of time. Plane tickets, transfer services, hotel rooms, restaurant tables, event tickets, and so on. If we are traveling for business, there are many other bookings to make. With many people around the world booking services from a fixed number of providers, have you ever thought about how does all that work?

This is a crucial point for the travel industry, and it is easy to understand why. To keep it simple: nobody wants to have a reservation cancelled because it was double-booked or it was actually sold out. Global Distribution Systems, or GDS, are the best solutions for such a massive issue. Here, we are going to learn their basics and check the most popular ones available to agencies.

What is a GDS and Why Does it Matter?

Global Distribution Systems are computerized networks which centralize data and grant travel service providers easier access to crucial information for their transactions. Such providers are airlines, hotels, car rental companies and cruise lines, to name a few. They become connected to travel agencies and destination management services integration platforms, whether physically or online, to send and receive travel-related information.

To keep it in a few words, a Global Distribution System compiles real-time information such as flight schedules, hotel rooms, and general fares, and distributes it to service providers. This way, travel professionals can access a variety of options from multiple suppliers whenever they need to offer services to their clients, including specialized travel booking systems for MICE events that require coordinated group reservations. As you can see, it is a centralized hub of information available for many purposes.

Core Functions of a Global Distribution Systems

- The GDS gathers availability data from multiple vendors.

- Travel agents use that data to offer services to their clients.

- GDS and CRS have separate functions which collaborate.

One last important topic to keep in mind at this point is that GDS is different from a Computer Reservation System (CRS). The CRS manages the flight seats or hotel rooms of a given vendor, while the GDS simply connects multiple CRSs to access their respective data. The GDS tracks the passenger’s entire request whereas each CRS only takes care of what it can offer to fulfil it.

How Has the GDS Evolved Over Time?

- American Airlines and IBM created the first GDS in 1960.

- Those systems quickly expanded from airline applications.

- Modern GDSs offer vast content and update it in real time.

- Travel agencies can optimize their use of manual labor.

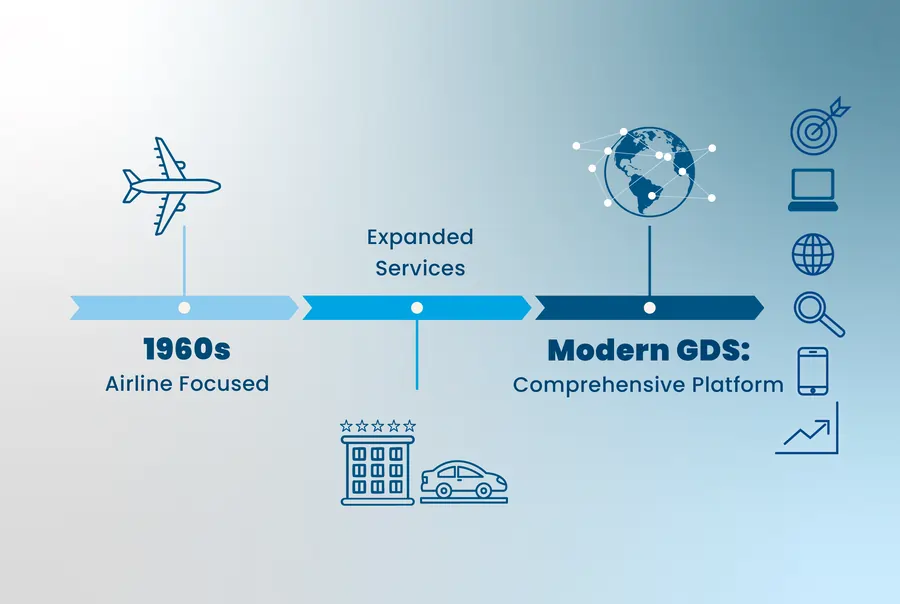

The GDS’s concept emerged in the 1960s, back when airlines created systems to manage their flight inventories, reservations, and ticketing processes. American Airlines partnered with IBM to release the Semi-Automated Business Research Environment in 1960. Shortened to SABRE, it was one of the pioneering systems in this industry and quickly became essential in that role.

Over time, Global Distribution System added many other functions to further assist the travel industry. Nowadays, it is an information repository which gathers data from multiple suppliers and can be accessed by users to easily search, compare, and book travel services. It is possible to book in real time, make last-minute changes, and obtain immediate confirmations in a simple and easy process.

Modern GDSs build on efficiency and transparency by automating routine tasks and comparing prices and offerings from several providers. This way, travel agencies can optimize their uses of manual labor and book the service option that offers the best value to their clients. The system also features reporting and analytics tools to help the agency monitor performance and trends.

Why is it Important to Modern Travel?

- GDSs have faced tough competition from other systems.

- They stay relevant because of varied content and intuitive use.

- Travel agents have access to many options at attractive prices.

- GDSs are shifting their focus to keep their market shares high.

Even though the modern market poses threats like direct selling strategies by airlines and price comparison websites, the GDS manages to stay relevant in the travel industry. After all, it offers unique flexibility and bulk-buying capabilities which individual airline systems cannot match – especially when the client makes wide research, a case that is becoming increasingly frequent.

Global Distribution Systems are also important to hotels and car rental companies because of their efficient disposal of last-minute inventory. Added to the global reach and reasonably low cost, that function makes GDSs still effective to generate additional revenue. That also marks a shift from the initial purpose, since the very first GDS was developed specifically for an airline.

Nowadays, while airlines increasingly explore direct selling and New Distribution Capabilities (NDC), GDS providers turn to hotels and car rental companies to keep offering their own value propositions. It is possible to conclude that those systems can adapt their functions to remain attractive, especially in travel segments where direct connections are less efficient or mature.

Overview of the GDS Market Leaders

The global market for Global Distribution Systems is primarily concentrated in three providers: Amadeus, Sabre, and Travelport – collectively, they control approximately 97% of the booking market. As you can imagine, they stay strong against one another by offering differences when it comes to history, geographic stronghold, and strategic focus. Let’s give them a detailed look:

Amadeus: from Spain to the World

- Spanish GDS provider that dominates the European market.

- Approximate market share of 40% in Europe and 37% globally.

- Over 90,000 travel agencies use Amadeus around the world.

- Serves hotels, cruises, airports, and car rental companies.

Founded in 1987 in Madrid, Spain, Amadeus is a global company focused on travel technology. At first, it was a consortium of major European airlines, such as Air France, Lufthansa, SAS and Iberia, and aimed to modernize the airline booking process. It has become the largest provider in the world, conquering a market share of almost 40% in Europe, and estimated 37% globally.

Active in over 190 countries, Amadeus offers a comprehensive travel ecosystem made by car rental companies, hotels, rail operators, cruises, and even airports. It has become popular for its innovation, scalability, and robust solutions. It also offers a unique IT solution for Customer Management which allows airlines to outsource their IT operations to a community platform.

Sabre: The North American Pioneer

- The very first GDS was developed in the US for an airline.

- Sabre now serves many segments of the travel industry.

- The provider focuses on mobility, and data-driven insights.

- It has unique functions to help airlines and travel agencies.

Based in the state of Texas, Sabre was initially developed by American Airlines and IBM. It soon overcame its original purpose and now powers booking systems for travel agencies and several other large companies across the globe, processing billions of transactions annually in order to hold 35% of global distribution. It has set many standards for the industry of travel technology.

Besides supporting several travel services from hundreds of thousands of providers, Sabre has been recognized for its pioneering solutions focused on automation and data-driven insights. It offers functions such as SabreMosaic™, an order-based retailing platform designed for airlines, and a Travel Marketplace where travel agencies can easily browse content from many sources.

Travelport: The GDS collective

- Founded in the UK after three GDS providers merged.

- The smallelobast of the three, yet still in a dominant position.

- Connects with 250,000 hotel properties around the world.

- Used by 68,000 travel agencies in over 180 countries.

This Global Distribution System provider is actually a suite of three platforms: Apollo, Galileo and Worldspan. Back in 2008, they merged into a single company based in the UK but still operate as separate entities. Travelport holds 22% of global market share, and is mostly strong in hotel and rail bookings. It connects with 68,000 agencies in 180 countries, which makes it smaller than its competitors.

Travelport positions itself as a commerce platform, bringing easy access to real-time inventory for travel sellers and providing innovative API solutions. It is recognized as a leading Hotel GDS because of Galileo, while Worldspan and Apollo historically focused on airlines. Travelport has a strong reputation in the travel business for its versatility and the extensive content it can offer.

What can we conclude about that?

While market share estimates dictate that each GDS is the leader in different regions, the truth is that they are all pursuing global expansion by diversifying their services. Following that path is natural, since we are talking about an inherently global industry. Business and tourism travel benefit from that trend because they can obtain more competitive offerings across the globe.

| GDS Provider | Headquarters | Founding Year | Primary Strengths | Global Market Share (est.) |

|---|---|---|---|---|

| Amadeus | Madrid, Spain | 1987 | Large OTAs, airlines, and global travel agencies | ~37% |

| Sabre | Southlake, Texas, USA | 1960 | North American travel tech companies, TMCs | ~35% |

| Travelport | Langley, Berkshire, UK | 2008 (merger) | Full-service travel agencies & global hotel distribution | ~22% |

Comparative Analysis of Amadeus, Sabre, and Travelport

While all three top GDS providers offer comprehensive services, their historical development, strategic investments, and market focus have built distinct competitive advantages over time:

Content variety

At a first glance, all three provide comprehensive content across travel sectors: flights, cruises, hotel rooms, car rentals, and railway operators, and even specialized event venue booking systems for corporate gatherings. Amadeus, for example, provides access to 435 airlines and 87,000 hotels, while Sabre connects travel agents to 50 rail carriers and 40 outlets of car rental. While Travelport is a strong contender, there are some differences in its offerings.

Travelport’s Galileo branch is focused on hotels, which has allowed it to connect with 650,000 properties besides providers in all the other fields. This Distribution System has made that bias its competitive edge, which is becoming increasingly important given that airlines are gradually moving toward direct selling channels of their own and/or New Distribution Capabilities, also known as NDCs.

In short, Travelport is using the tried-and-true strategy of diversifying its services so as to shield itself from the impacts of an everchanging customer demand. If the travel agency has primary focus on hotel bookings, especially for extended corporate travel, the Galileo platform renders Travelport more useful and attractive than the other GDSs despite its (slightly) smaller network.

Technological capabilities

Investing in cutting-edge technology is a common trait here. Artificial intelligence, API solutions and cloud computing have all become essential to enhance the GDS platforms and keep them competitive. Then again, it is possible to observe a few differences when it comes to how each global distribution system uses those technologies to offer the best service to travel agencies.

Amadeus offers robust, cloud-based solutions and makes a heavy use of generative AI through strategic partnerships. Sabre, in turn, applies automation and data-driven insights to establish new standards in the field and offer smarter and faster travel experiences. Travelport is focused on API solutions to stay secure and robust and applies AI-powered search controls for retailing.

Those GDS providers partner with tech companies to adapt themselves to the latest customer demands. More than simply adding content, they work towards sophisticated modern retailing, personalized and optimized offers, and enhanced end-to-end capabilities. We can say that the modern GDSs have gone from mere booking systems and become travel technology platforms.

New Distribution Capabilities (NDC)

This acronym stands for an IATA-led XML-based data transmission standard created to enable airlines to distribute richer content, personalized offers, and dynamic pricing directly to travel sellers, moving beyond the traditional EDIFACT protocol. It is easy to realize that its adoption in the travel industry over the past few years represents a significant change within its activities.

Amadeus is embracing content fragmentation by dealing with content in various formats so as to simply access for travel sellers. Sabre is a leader in NDC integration, especially in terms of high-scale use, and enables flexible rates and customized offers to travel agencies. Travelport has also used NDC in a multi-source content platform and offers an API suite for retailing tools.

While New Distribution Capabilities (NDC) were originally created to facilitate direct airline distribution, it has become a key component of modern GDSs. It would be too complex for travel agencies to integrate with NDC APIs of all airlines, so GDSs are now offering a unified platform for traditional and NDC content. More than offering content, they are now curating the options in order to remain indispensable.

| Key Features | Amadeus | Sabre | Travelport |

|---|---|---|---|

| Coverage | 435 airlines, 280+ hotel chains (87K hotels), 103 rail, 29 car rental, 51 cruise | 400 airlines, 200K+ hotels, 50 rail, 40 car rental, 17 cruise | 650K+ hotel properties, 400+ airlines, 50 cruise/ferry, 19 rail |

| Geographic Strengths | Dominant in Europe, growing in Asia Pacific | Leader in North America & Asia | Strong user base in USA, global connector |

| Key Technological Focus | Cloud-based solutions, GenAI, Altéa CMS, partnerships with Microsoft/IBM/Google Cloud exploration | AI-powered analytics, Sabre Travel AI™, SabreMosaic™, Google partnership | Commerce platform, cutting-edge APIs, Travelport+, AI-powered search, Cognizant partnership |

| NDC Strategy | Aggregation of EDIFACT/NDC/LCC, high NDC penetration, 30+ airlines with exclusive NDC content, IATA certified | Claims “More NDC airlines than any other GDS,” “Beyond NDC” program, focuses on unlocking NDC at scale | Agency-centric NDC via Travelport+, multi-source content (NDC, ancillaries), “Smart Curation,” Smartpoint/API access |

| Hotel Focus | Comprehensive, but not primary differentiator | Comprehensive, includes SynXis platform | Leading Hotel GDS, Galileo more hotel-centric |

| API Support | Robust API for airlines, hotels, rail, insurance | Rich API support for bookings, analytics, mobile apps (Sabre Dev Studio) | Cutting-edge API solutions for real-time inventory access |

How to Choose Your Global Distribution System provider?

As you can imagine, there is no absolutely right answer. This selection depends on the specific needs of the travel business as well as its operational efficiency, profitability and market reach.

Business needs and specialization

The initial step is to assess the travel business’s focus and model. Large agencies benefit from scalability and comprehensive IT solutions, which renders Amadeus a great option. However, businesses based in North America may prefer Sabre for its historical roots as well as its focus on the corporate booking tools. Travelport is more versatile regarding global hotel distribution.

Though all GDS providers offer broad content, there are details to observe: besides Travelport’s focus on hotel inventory, Sabre is centered in North America. It is not only about the volume of available content anymore; the travel business must understand the nature of each GDS so as to find which one better aligns with its own goals and strengths to become an efficient partner.

The use of new technologies plays an important role as well. Data-driven insights, generative AI and NDCs are used by each GDS in a different way, which means they will not suit each agency in the same way. The goal is to discover the global distribution system whose solutions are the most compatible with the travel agency’s own or the ones it intends to adopt in the near future.

Future-readiness and strategic vision

Since GDS providers are constantly updating their platforms to stay on top of the latest trends, it is essential to think forward when choosing the one to use. NDCs are gaining relevance in the field, especially for airlines, so their GDS must offer seamless integration and high capabilities for NDC besides traditional content. This capability is becoming a norm in airline distribution.

When it comes to innovation, the travel agent must study what each GDS provider offers so as to foster its own work regarding personalization, efficiency, and the ability to find new revenue opportunities. Robust API support is also important, since it facilitates integration between the GDS and existing systems and allows the business to develop custom solutions to its needs.

Integration and Operational Efficiency

Speaking of integration, it goes without saying that the appropriate GDS integrates smoothly with the travel agency’s existing technology, which includes its Property Management System (PMS). That integration can automate processes, bring real-time updates, and pave the way for optimized manual labor, which reduces the potential for errors and improves overall workflow.

Even though it is facing tough competition from many sources, the Global Distribution System remains relevant and effective for the travel industry’s needs, particularly for domestic travel distribution where local inventory management is crucial. To that end, it has continuously adapted to the ever-changing demands of the market and embraced the newest technological advancements. Amadeus, Sabre, and Travelport have all managed to stay strong and proactive.

Cost is another relevant topic, since some airlines impose GDS surcharges – the business has to factor them into its operational budget. In other words, while a GDS is highly efficient, there might be options with lower cost in some situations. It is also important to consider customer support, training resources, and the access to developer communities that each GDS provides.

Travel Business is an Evolving Landscape

Amadeus is an European powerhouse, offering innovation, scalability and several IT solutions that go beyond traditional distribution. Sabre has deep historical roots and extensive network and pairs them with data-driven insights, AI, and modern retailing to set new standards in this field. Travelport has massive content aggregation and modern API solutions to simply retailing.

Once airlines moved toward direct selling and NDCs emerged, GDSs were expected to decline. However, they bounced back by embracing those new trends, adopting new technologies, and even rethinking their overall format in order to accommodate the travel industry’s latest needs and trends. Over the years, they converted a trend of obsolescence into proactive adaptation.

Nowadays, Global Distribution Systems are more than transaction facilitators. They turned into content aggregators that simplify and curate the diversity of options available in an increasingly fragmented travel market. By aggregating content from traditional EDIFACT, modern NDC, and other proprietary formats, GDSs render integrations much easier for travel agencies of all sizes.

It is also worth noting that hotel and car rental industries continue to use GDS for global reach, and inventory management. While the GDS market remains highly concentrated with the three major providers, their intense competition implies continuous investment in overall innovation as a way to try and further expand themselves into new capabilities and geographic locations.

Global Distribution Systems are the digital backbone of the travel industry and, to that end, are constantly evolving. They will likely stay indispensable for travel agencies and other providers who need efficient and intelligent access to an ever-increasing travel inventory. Their continued success hinges on the ability to simplify variety and add value for users in a dynamic industry.